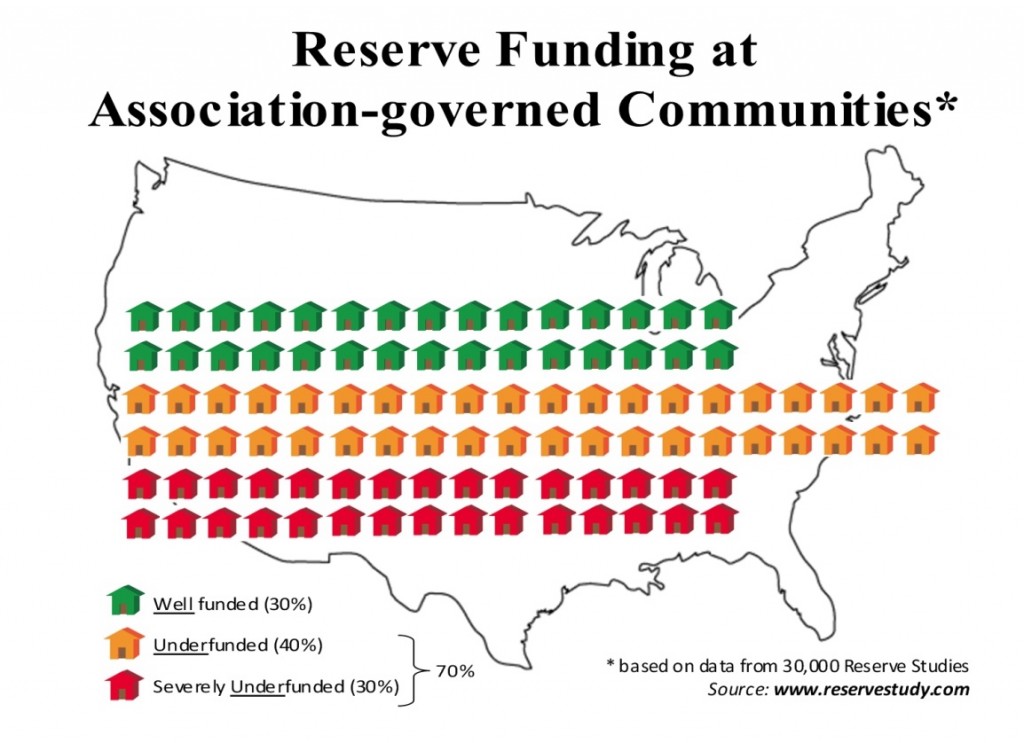

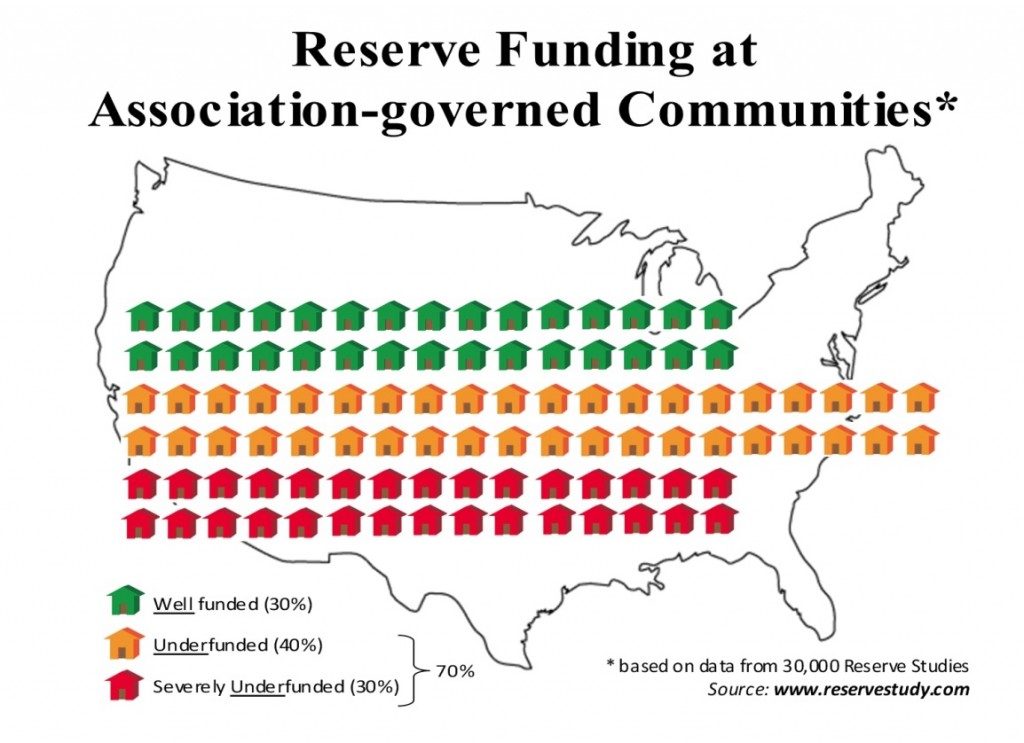

A Whopping 70% of Association-governed Communities are Underfunded

Underfunded reserves is a financial reality throughout the United States. This statement is made based on an analysis of over 30,000 Reserve Studies prepared by our company in the 21-year time period from 1992-2012, using terminology and calculation protocols established in National Reserve Study Standards.

The results, which were based on a measure of Reserve Fund strength called “Percent Funded”, determined that over70% of Associations were under 70%-Funded.

This comparison of results from several different 2-year periods shows that the number of Associations that are underfunded today has increased by 12.5% since 10 years ago:

| Years | % of Underfunded Associations | # of Reserve Studies analyzed |

| 1992-1994 | 62% | 2016 Reserve Studies |

| 2000-2002 | 59.5% | 2938 Reserve Studies |

| 2010-2012 | 72% | 8374 Reserve Studies |

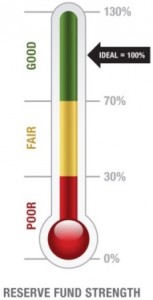

Reserve Fund Strength Explained

An Association’s reserves are considered “underfunded” when the Reserve Fund Strength at the start of their fiscal year is less than 70%-Funded. This means that the amount of money in an Association’s reserve account is less than 70% of the amount required to match the current common area deterioration.

% Funded = Reserve Fund Balance (actual)/Fully Funded Balance (computed)

Common area deterioration can be “monetized” by a term called “Fully Funded Balance”. Fully Funded Balance is the computed value of the deterioration of the association’s common area assets. This figure is determined by multiplying the “fractional age” (Age/Useful Life) of each component by its current estimated Replacement Cost, then summing them all together.

Let’s consider a simple example:

Imagine an Association on the first day of their fiscal year, with a $40,000 Reserve Fund and only two reserve components: a 7 year old roof on a building that was painted 3 years ago. First we’ll need to make some assumptions: Let’s assume a Useful Life of 20 years for the roof and a current replacement cost estimate of $200,000. For the building, let’s assume a Useful Life of 5 years for re-painting at a current cost estimate of $50,000.

The roof deterioration can be monetized as 7/20ths of $200,000, or $70,000. The paint’s deterioration can be monetized as 3/5ths of $50,000, or $30,000. So the total common area deterioration since the last time the roof was replaced and the last time the building was repainted (also known as the association’s Fully Funded Balance) can be computed as $70,000 + $30,000 = $100,000.

Now let’s do the %-Funded calculation:

% Funded = Reserve Fund Balance (actual) $40,000 /

Fully Funded Balance computed) $100,000

= 40% Funded

Having $40,000 on hand in reserves compared to a $100,000 Fully Funded Balance means that the Association is 40% Funded. The Association is “behind” in collecting funds that will allow them to complete the roof replacement and re-painting project in a timely manner. Special Assessments or loans will be required to bridge the funding deficit or necessary repair & replacement projects will have to be deferred.

While many states do not legally require Associations to “adequately” fund reserves, funding reserves at a rate that keeps close pace with common area deterioration is a wise and responsible course of action. Associations across the nation are in a financially challenging state, and the consequences of continuing to underfund reserves are too important to be ignored.