“We’re an old church; we just replace things when they break.” This is the common response when I ask church leaders throughout the nation about their long-term capital planning strategy. While this statement might b e t rue for many worship facilities, for many years, that doesn’t mean it’s the wisest form of stewardship for a church’s physical assets.

At a glance, waiting for building components to fail — such as roofs and asphalt — might seem like a sound strategy. Financial resources are devoted to ministry while physical assets simply sit in the background and fulfill their intended purposes.

It’s only when building failures start to occur that the issue comes to light. These failures come as a “surprise,” despite the fact that the remaining useful life and replacement costs of the major components can be predicted with great reliability.

Often, those charged with overseeing the church’s physical plant are unsure of what assets should be in a capital plan. Fortunately, a national-standard, four-part test is available to determine which expenses should appear in your church’s capital plan component list.

The component must:

• Be a church maintenance responsibility

• Have a limited life

• Be predictable (otherwise, by definition, it’s a surprise, which cannot be accurately anticipated)

• Be above a minimum threshold cost — often between .5 percent and 1 percent of a church’s total budget.

This limits capital components to major, predictable expenses. Within this framework, it’s inappropriate to include lifetime components, unpredictable expenses (such as damage due to fire, flood or earthquake), and expenses more appropriately handled from the operational budget or as an insured loss.

It’s certainly true that capital assets are easy to forget about. A new roof — depending on the type of construction — can last 15, 20 or even 30-plus years. AC units and boilers run on thermostats and normally require little attention. Vehicles can be driven over asphalt parking lots for many years without a second thought.

However, a reactive approach typically equates to expensive deferred maintenance — leaky roofs, causing mold and interior damage; AC systems failing catastrophically in the summer heat; boilers needing hard-to-find replacement parts in the dead of winter; and parking lots riddled with potholes and trip-and-fall hazards. Imagine a church with a 30-year-old roof in late December. Inevitably, it seems, that roof will leak right before the Christmas Eve service. The result is an unnecessary waste of time, talent and treasure.

Capital planning means:

• Knowing when the roof will reach the end of its useful life, and

• Setting aside the right amount of money to offset the accumulated roof deterioration.

The reward for being proactive is being in a position to replace the roof before it fails. Planning to replace a roof when the weather is right; obtaining a professionally specified replacement system to include all appropriate water-proofing details; having time to review a set of competitive bids; and, ultimately, scheduling the work around worship, meeting and other activities held on-site will result in the most efficient use of time, talent and treasure, along with the least amount of disruption to the day-to-day life of the church.

WHAT EXACTLY IS A CAPITAL PLAN?

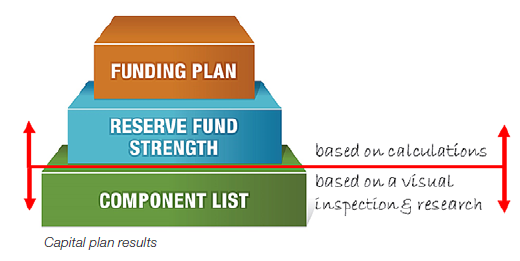

A capital plan is a vital tool that will improve stewardship of your church’s physical assets. A professionally prepared capital plan will be customized to your facility and contain three key results.

1) Component list

The component list serves as the foundation of every capital plan. It outlines the scope and schedule of all major, predictable repair and replacement projects. Some of the most influential items might include roofing, painting, asphalt, flooring, HVAC systems and restrooms.

2) Reserve fund strength

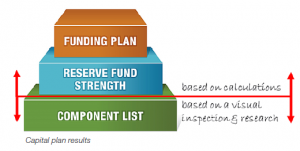

The reserve fund strength is a calculation that compares how much money has already been set aside “in reserve” to the capital asset deterioration that has already occurred.

% Funded = Reserves ($) /Accumulated capital asset deterioration ($)

Capital asset deterioration can be expressed in the form of currency by factoring in the remaining useful lives and replacement costs of all components on the component list. In the above equation, “% Funded” provides a clear and scalable indicator of how financially prepared your church is to make necessary repairs to its buildings, where 100-percent funded is ideal.

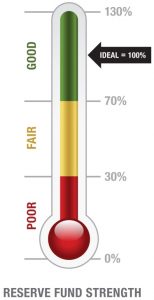

3) Funding plan

The final result — the funding plan — identifies how much money needs to be set aside “in Reserve” each year. Since most organizations start off at less than the ideal 100-percent funded, the funding plan might require stable monthly contributions to reserves that are large enough to avoid last-minute fundraising campaigns. The goal, over time, is to move the church in the direction of being more than 70-percent funded.

A capital plan reveals the true cost of properly maintaining the buildings that have been entrusted to church leadership. Knowing the truth (and responding to it) is a foundational concept of the Christian faith; it’s wise to apply that same approach to the stewardship of a church’s physical assets.

Since the remaining useful life and replacement costs of the church’s major components are all reliably predictable, it would be foolish to characterize most building failures as “surprises.”

Establishing a strong reserve fund takes time and fiscal discipline. The benefit of creating a capital plan is that your church has a sound evaluation of both its physical and financial condition, as well as a prudent course to properly care for and maintain the property.

In the long run, your church will be rewarded with efficient use of time — and stewardship dollars — so the focus can be on the true mission of the church: preaching the Good News!

———————————————

Matthew Swain, RS, is Worship Facilities Specialist at San Diego-based Association Reserves. He is a certified Reserve Specialist and has been preparing capital plans for non-profit organizations across the country for more than a decade. Swain currently serves as the national representative for Association Reserves worship facility clients.

This article originally appeared in Church Executive Magazine.