It’s getting to be that time of year when most Community Associations begin the annual process of planning and adopting next year’s financial budget. For associations small and large, whether condo, HOA or otherwise, this is arguably the most difficult and most important task that Boards and their Managers will tackle in the course of doing business.

There are estimates to be obtained, contracts to be negotiated, and tough decisions to be made regarding next year’s forecasts. The Managers we work with routinely say that it’s the most stressful part of the year… and they’re the ones getting paid for the work they do. For volunteer Board members, it’s the time of year that may make you question why you ran for that position in the first place!

Managing the Reserve Fund

One of the challenges many associations face is what to do about the Reserve Fund. Unlike the other line items in an association’s annual budget, the amount to budget for long-term repair and replacement of common area assets can be a little bit tricky. How do you know how much is enough? There are income statements and balance sheets with plenty of good-sounding numbers, but is this the whole story?

Let’s try a simple exercise. An acquaintance tells you he’s the treasurer of his homeowner’s association, and he’s just been reviewing the current financial statements. His association has $500,000 in their Reserve Fund account, and he’s going to speak at their annual membership meeting to deliver the good news to the rest of the homeowners. He thinks they can probably cut next year’s in half. After all, they’ve got half a million in the bank, right?

You know nothing but what he’s told you. If the Treasurer lived in a fairly new condo building with one pool and a tennis court, you’d probably figure they’re in great shape. But what if he represents an aging 200-home community with crumbling roads, dilapidated amenities, and a 3,000 square foot clubhouse that needs a new roof and a paint job? How would that change your perception of things?

By now, you’re appreciating that dollar balances don’t tell the whole story. To truly know where an Association stands financially, they’ve got to have something to compare against. When it comes to Reserve funding, this means comparing the actual reserve account balance to some kind of benchmark.

National Reserve Study Standards & the Reserve Fund

National Reserve Study Standards define this benchmark as the “Fully Funded Balance”. “Fully Funded Balance” (FFB) is a financial representation of the “ageing” of the common area components. Ageing (also known as deterioration) is as normal and inevitable for buildings as it is for people! The physical deterioration of a building starts the moment new construction is completed and starts afresh after each cycle of common area repairs & replacements.

Let’s use a simple example to show how FFB is calculated. Imagine the roof of your Association was replaced 5 years ago and you were told that the roof had a life expectancy of 20 years. If the current cost to replace the roof is $100,000, how much money should the Association have already saved “to be on pace” with the roof’s deterioration? The answer should be intuitive-$25,000, right? The roof has “aged” (or used up) 25% of its Useful life, so it makes sense that the Association should have 25% of the $100,000 replacement cost on hand. That’s it. Notice that there’s no mention of how much the Association actually has on hand today, only that $25,000 is the amount the Association should have on hand today. FFB is a theoretical amount corresponding exactly to the 5 years worth of actual “roof deterioration.”

Percent Funded: A Measure of Reserve Fund Strength

Taking this process a step further, we are able to calculate in real terms exactly how well the Reserve Fund has kept pace with common area deterioration. We express this relative strength in terms of Reserves “% Funded”, another fairly simple National Reserve Study Standard calculation involving FFB:

“% Funded” = Actual Reserve Balance

Fully Funded Balance (FFB)

So, if the Association has $25,000 actually sitting in the bank for the new roof after 5 years, and the roof’s FFB is $25,000, the “% Funded” is $25,000 divided by $25,000 or 100%.

Remember, “% Funded” measures how well the Reserve Fund has kept pace with deterioration, and 100% Funded means perfectly “on pace”!

In reality, an Association’s common area consists of dozens of different reserve components, each with unique useful lives, remaining useful lives, and replacement costs. So a measurement of whether the Reserve Fund is “on pace” only has meaning when it is based on a “% Funded” calculation involving all repair & replacement projects.

Why Percent Funded is Important: Accountability & Special Assessments

Now that you understand what it is and how it’s calculated, you might be wondering why “% Funded” is so important. There are two reasons:

The first reason goes back to that Treasurer acquaintance who’s preparing to address the homeowners at the upcoming annual meeting. He knows the amount of the Reserve Fund is ½ a million dollars and he’s ready to publicly pat the Board on the back for having so much money set aside. But does he really know if the Reserve Fund has “kept pace” with the actual common area deterioration? Can he assure the homeowners that the Association is in a position to perform timely repairs & replacements? Is he prepared to have prospective buyers rely on his personal assessment of the situation to make an informed purchase decision? Reserves “% Funded” is the only meaningful, independent, and reliable measure

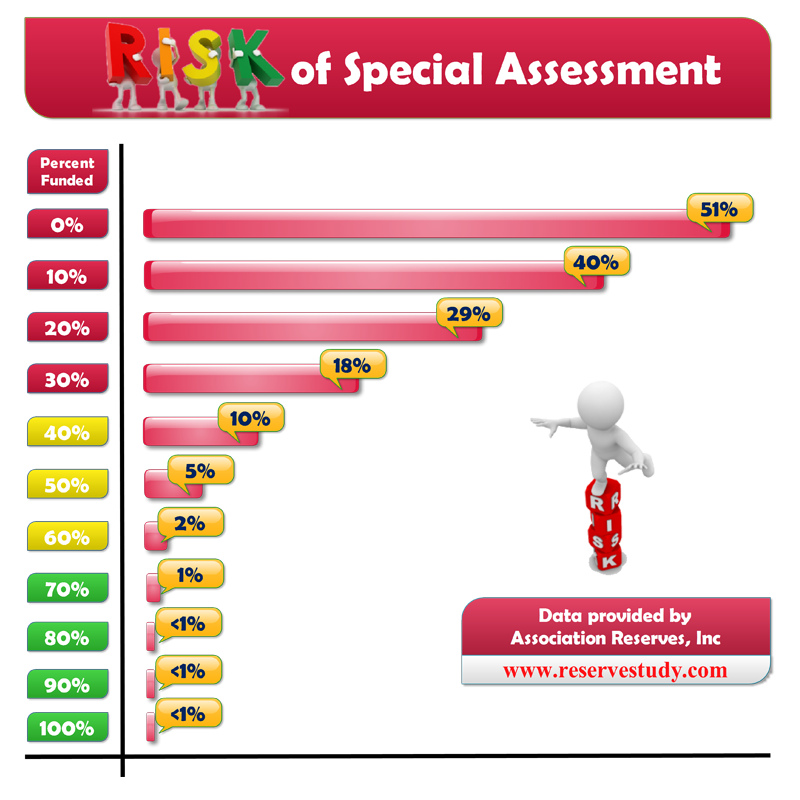

The second reason Reserves “% Funded” is so important is that it can be a reliable predictor of the likelihood of special assessments. This colorful infographic demonstrates the relationship between “% Funded” and the Risk of Special Assessment.

Associations above 70% Funded (the green zone) have a less than 5% chance of ever needing a special assessment to make timely repairs & replacements. By contrast, Associations less than 30% Funded (the red zone) are likely to need a special assessment every 2 or 3 years. Notice that there’s no mention here of dollar amounts. The only way to know whether a Reserve Fund is “on pace” with deterioration is by comparing the actual amount in reserves against the FFB benchmark to compute Funded.

A Reserve Study Guides Your Reserve Fund

Hopefully you can see now that Reserves “% Funded” is a valuable calculation that needs to be made by every Association every fiscal year. There are many other important steps along the way to a financially successful future, including keeping the Component List (detailing the scope and schedule of reserve projects) up to date, a proper projection the actual Reserve balance, and a well-crafted Funding Plan going forward, with an

emphasis on avoiding special assessments. Many associations choose to use a professional Reserve Specialist to help with this process, which ensures that the calculations are accurate and the forecasting is done by a competent, independent professional with experience helping similar associations. Whether a Manager or Board member chooses to take on this process internally or looks outside for assistance, knowing and understanding Reserves “% Funded” is the only way to gauge whether the Association is keeping pace with ongoing deterioration and setting themselves up to finish strong!