Because association boards are run by volunteers with typically high turnover, fundamental education will always be at the heart of their success. Within my 2014 newsletters to you, I will address typical misconceptions and objections with reserve planning, and arm you with insight and strategy using information commonly found in your reserve study deliverables.

In our February newsletter we looked at some of the problems associated with the requirement that your reserve study be a 30-year forward looking budget model, and the typical objection: “why do we care about paying for something 20 years down the road.” (Feel free to send me an email if you want a copy). In this newsletter, we will look at the significance of inflation on your reserve plan and the balance between providing you a one-year budget recommendation against 30 years of maintenance, repair & replacement expenses. See also Effects of interest & inflation article on our web site.

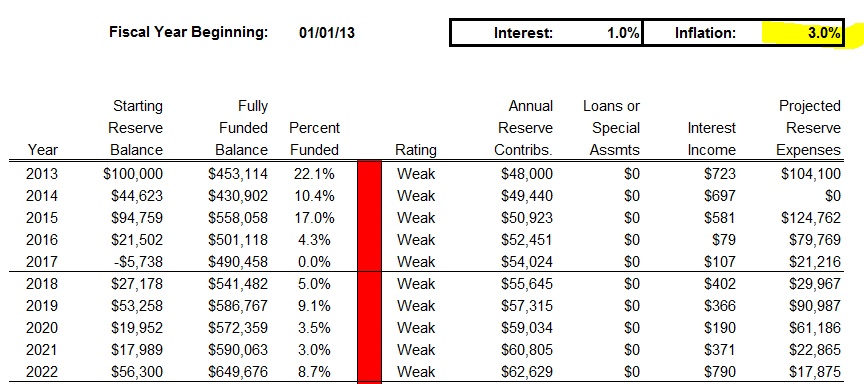

“Ok, we can see that ignoring interest and inflation is unwise, but why do you use an average inflation factor that is higher than the current CPI?” The answer is a matter of policy judgment on our parts, as there is no index that collectively tracks the goods & services you will find in a typical reserve study: roofing, painting, asphalt, siding, windows, decks, etc… Our experience in providing over 30,000 reserve studies since 1986 indicates these types of expenses increase at a higher rate than the basket of goods used as basis for the CPI. Coupled with the fact that most of our association clients in Washington are at medium to high-risk of special assessment, below 50% funded, using 3% inflation is what we believe is the best balance when planning for our association clients. Consider the chart below based upon 1% inflation compared to the subsequent chart using 3% inflation. Using a more realistic inflation rate than CPI can result for many in having “enough”, versus a special assessment or deferred maintenance scenario.

You may also ask “why then don’t we plan for interest to offset inflation?” First, you will have money flowing in and out of the reserve fund (therefore principal will fluctuate) while the entire list of expenses is steadily inflating. Secondly, if you’re association is like most, your reserve cash is significantly less than the accumulated deterioration of your reserve components and therefore interest earnings cannot come close to keeping pace. We give you tools and guidance to answer these types of questions and objections. These scenarios can easily be run yourselves with the Excel based finanical analysis software we provide with each and every report. You will find a video tutorial showing you how to conduct “what-if” scenarios posted along with your final report in our web client center.