When does maintaining HOA reserve components become a drain on your budget, and when is it time to consider a full replacement? And how do you properly replace these assets without adding unnecessary pressures on costs for your community? Understanding how to manage HOA reserve components and mastering advanced reserve strategies can make or break your community’s cash flow, property values, financial health, and owner satisfaction.

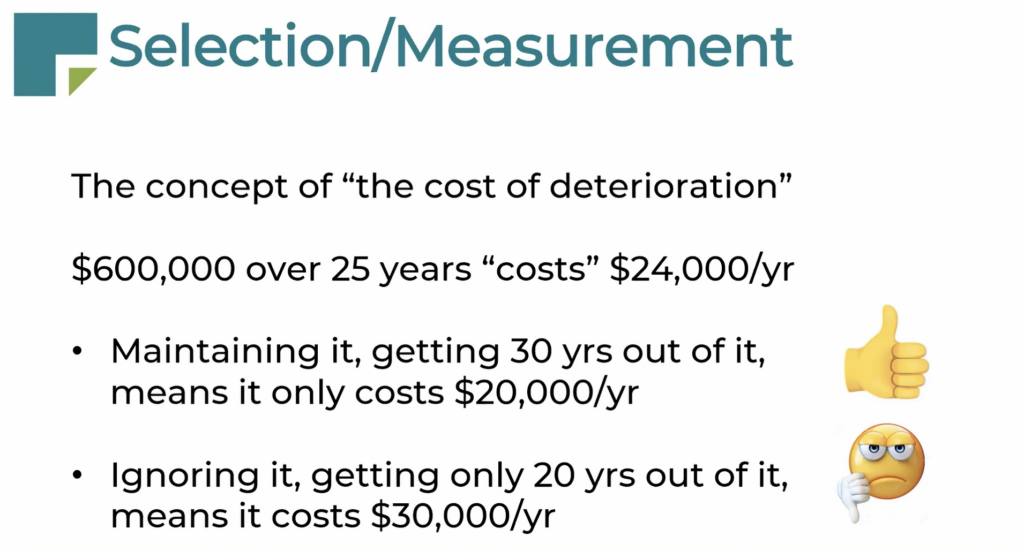

At the heart of effective reserve planning is the ability to measure one component against another to gain a metric for better decision-making. This starts with understanding the deterioration cost (the annual cost of a component’s wear and tear). Your ongoing reserve transfers are designed to offset this very cost. If your funding falls behind this offset, you’ll face having to sharply increase funding in the future for your owners.

In this HOA reserve components guide, we’ll break down advanced budgeting and management concepts using real-life examples from our experts to help you make informed decisions about your community association’s most valuable assets.

Extend Useful Life with Proactive Maintenance

One of the most powerful strategies to save your HOA money is to extend the useful life of your components through proper, proactive maintenance. This doesn’t mean delaying replacements, it’s about reducing the overall life cycle cost of an asset so you can get more years out of it.

Consider a $600,000 roof. If you invest in proper maintenance, such as annual cleanings and roof inspections, you could extend its useful life from 25 to 30 years. This seemingly small extension reduces the annual deterioration cost to $20,000, saving your HOA $4,000 per year, or $120,000 over a 30-year span! Conversely, neglecting even minimal maintenance can drastically reduce a component’s lifespan. A roof that only lasts 20 years due to neglect will have an annual deterioration cost of $30,000, an extra $10,000 per year that could have been avoided.

Good maintenance is an ongoing cycle of care, affecting almost every project on your reserve study component list. Routine inspections and care, even beyond the reserve study, can help catch small problems before they escalate into costly issues and upset homeowners when the bill comes due.

When to Repair vs. When to Replace Your Reserve Components

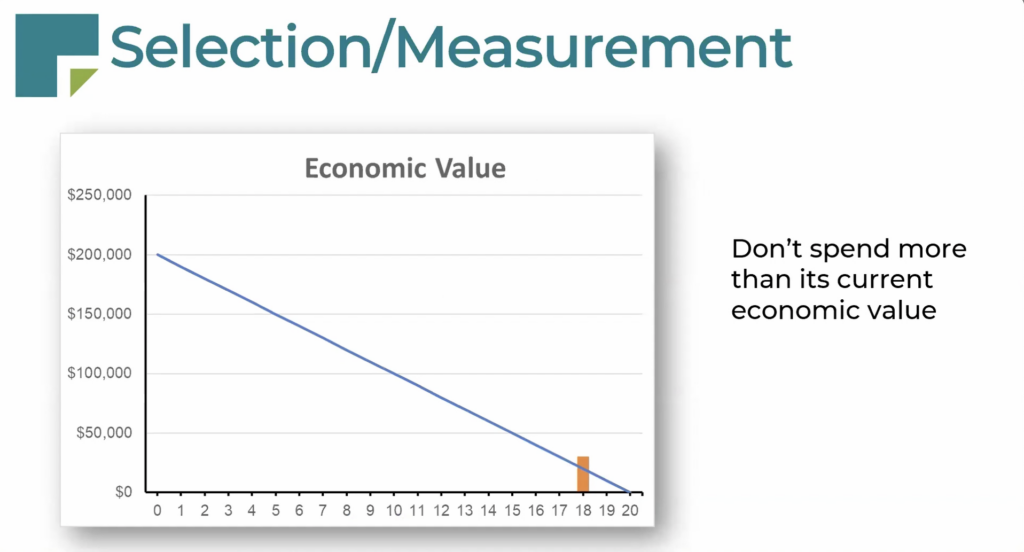

It’s tempting to continuously repair a deteriorating asset to avoid the large upfront cost of replacement. However, there comes a point where spending more on repairs becomes financially unsound, “spending good money after bad.”

This is where your component’s economic value comes into play. For a $200,000 project with a 20-year life, in its 18th year, it has only $20,000 of its economic value remaining. A proposed $30,000 repair at this stage would exceed its remaining value, indicating it’s time for replacement, not further repair. This test of economic value helps your HOA board decide when it’s finally time to pull the trigger on a major replacement.

Designing Your Reserve Components List for Maximized Cash Flow

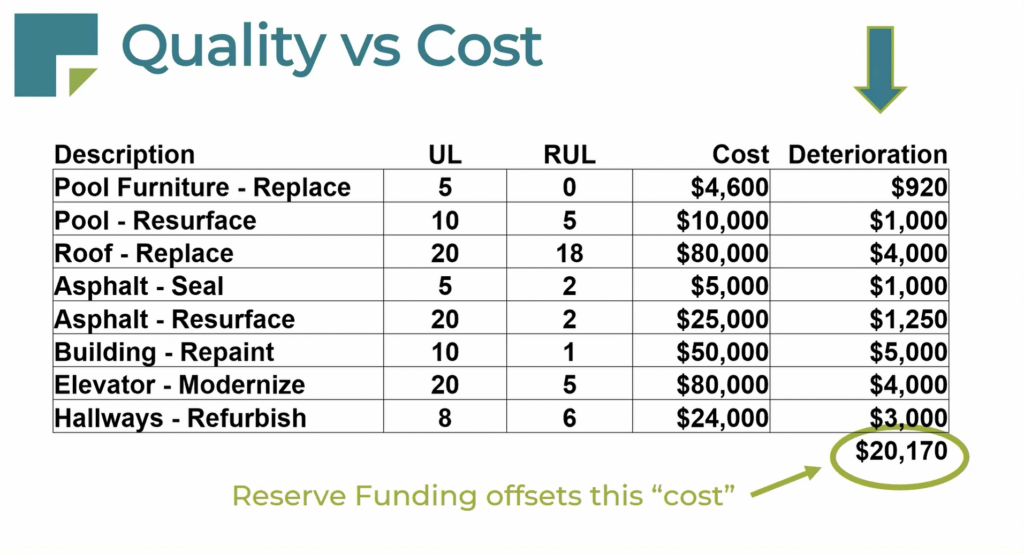

To truly maximize your HOA’s cash flow and minimize reserve funding, you need a well-thought-out reserve component list that guides wise decision-making. When reviewing your reserve study, pay close attention to the “deterioration” column, which shows the cost per year for each component. This shows you which projects are truly significant, as the biggest project cost isn’t always the most significant in terms of annual deterioration.

For example, an $80,000 roof might be less significant than a $50,000 building repainting if the repainting is needed more frequently.

More Ways to Save Money for Your HOA:

- Asphalt Maintenance: Implementing sealing projects can drastically extend the useful life of asphalt roads, making it a more cost-effective option than letting it deteriorate quickly.

- Repainting and Resealing: Regularly repainting and resealing wood and metal surfaces prevents higher repair costs and extends the useful life of siding and decking.

- Mechanical Equipment & Gates: Preventive maintenance on mechanical equipment and vehicle gate hinges can double their useful lives.

- Outdoor Furniture: Refurbishing and re-strapping outdoor furniture can be more cost-effective than frequent replacements.

- Hallway Carpeting: Regular shampooing and cleaning of hallway carpeting extends its life. For carpet tiles, having a surplus allows for swapping out troubled areas.

- LED Lighting: Switching to LED fixtures or retrofitting existing ones significantly reduces monthly utility bills, freeing up funds for other critical areas, including reserves.

Real Life Examples: How to Save Money for HOA Homeowners Properly

1. Elevator Modernization: Phasing Out Reserve Components

The Problem: A 100-year-old building with two six-story elevators facing expensive and multi-month modernization, with a desire to avoid having both elevators down simultaneously and a dwindling supply of qualified technicians and parts for the old equipment.

The Solution: Instead of a single, massive project, the HOA decided to modernize one elevator first, and the second five years later. Given that many units were second homes and often unoccupied, one elevator could still serve the residents. This approach effectively spaces out cash flow, stretching the life of the old unit 5 more years while preparing for its eventual replacement. The key was understanding that the hoist motors were fine; the issue was the old, mechanical control systems, which could be replaced with modern, electronic, and easily maintainable technology.

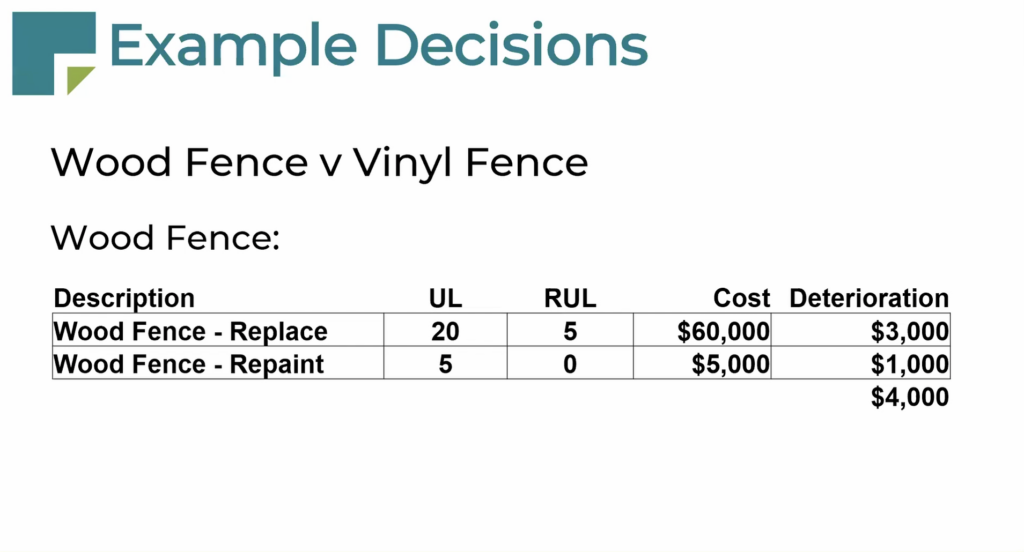

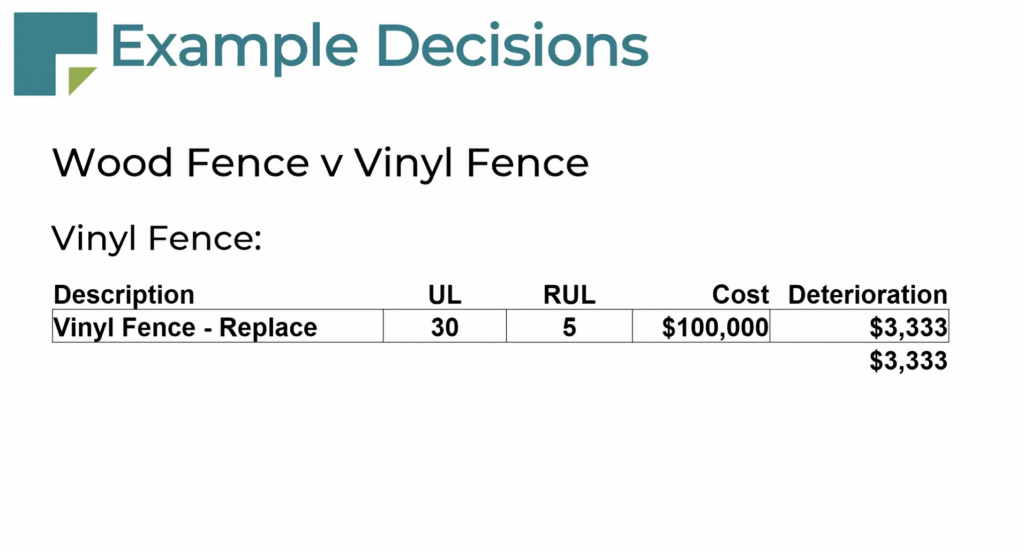

2. Vinyl Fencing: Prioritizing Long-Term Over Upfront Cost

The Problem: High lumber costs for wood fencing, plus the ongoing expense of repainting or resealing. Considering a pivot to vinyl fencing, which has a higher upfront cost.

The Solution: While vinyl fencing is more expensive initially, its longer useful life means a lower annual deterioration cost. For instance, if wood fencing costs $4,000 per year in combined expenses, vinyl might only be $3,333 per year due to its extended life. See how the highest upfront cost doesn’t always translate to the most expensive option overall. It’s crucial to consult with your reserve specialist to understand the long-term financial impact of replacement decisions like this.

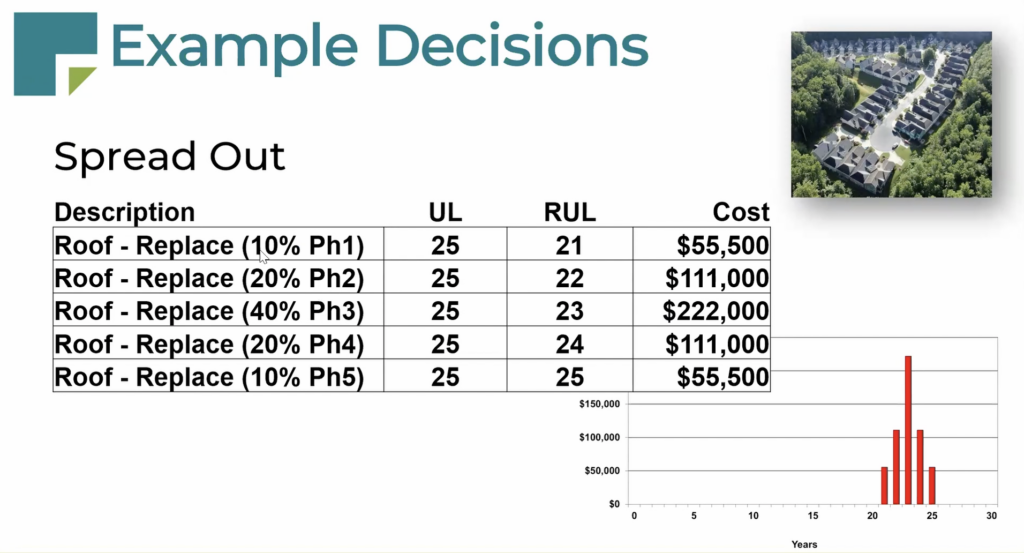

3. Roofing: Spreading Out Large Reserve Projects for Smoother Cash Flow

The Problem: A relatively new property has 74 buildings, each needing a roof replacement. The initial thought is that this HOA will need a single, large $555,000 project in 23 years.

The Solution: Recognizing that roofs wouldn’t all fail simultaneously, the HOA decided to spread the replacements over five years. This plan anticipated that different roofs would fail at different times. This simplifies cash flow, allows the association to test roofers on smaller portions of the project, and creates more manageable HOA expenses over time.

Why HOA Proactive Maintenance Projects are Non-Negotiable

Avoiding spending on maintenance often leads to “scope creep,” where minor issues balloon into significantly larger, more expensive projects than the original project. For example, failing to paint wood siding on time can lead to wood rot, requiring carpentry costs in addition to painting for your homes, condos, or townhomes.

Besides the large financial hit of additional replacement costs, lack of maintenance can:

- Decimate Property Values: A deteriorated HOA property with unkempt amenities will not help command top dollar, potentially costing homeowners tens of thousands in unit value.

- Increase Insurance Premiums: Neglected hazards like damaged sidewalks or docks can lead to higher insurance premiums or even loss of coverage.

Effective HOA reserve component management is not just crunching numbers and choosing the biggest projects, it’s about strategic foresight and proactive decision-making. By practicing preventive maintenance, understanding the economic value of your components, and designing a tailored component list, you can minimize reserve funding requirements, maximize cash flow, and ensure your community association remains a desirable place to live.

Don’t wait for problems to become crises! Plan ahead, plan wisely, and leverage the expertise of reserve study professionals to guide your HOA towards a secure financial future.