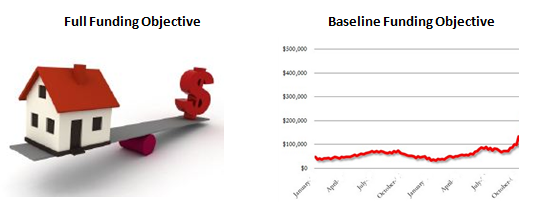

Reserve Funding Objectives

The two most common Reserve Funding objectives are Full Funding, where the Reserve Fund is designed to exactly offset the amount of Association deterioration, and Baseline Funding, where the Reserve Fund is designed to stay cash-positive at all times.

A Full Funding objective is more conservative, because fully-funded Associations maintain a higher Reserve Balance through the years (i.e., as deterioration grows or falls, so does the Reserve Fund). So what could be wrong with an objective to stay cash-positive? Why should any Association store up extra cash in the bank?

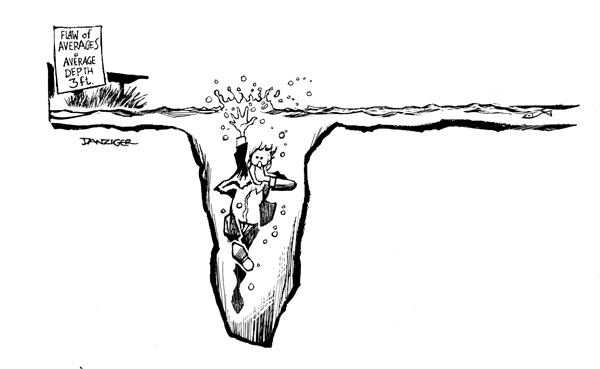

Baseline Funding and The Flaw of Averages

The issue is clarified by what’s known as “The Flaw of Averages”, a book by Dr. Sam Savage, a professor of Management Science & Engineering at Stanford University. The problem with the “flaw of averages” can be easily shown in the following illustration.

If one extreme side of a calculated “average” creates a critical problem, basing your actions on “average” can be foolish.

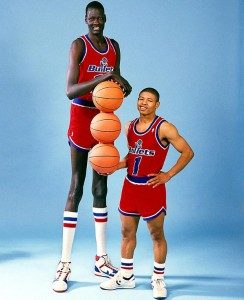

Consider this other example: Two basketball teams may “average” the same height of players, but if one team has a significantly taller player that can camp out under the offensive basket to score easy dunk shots, or present a key defensive obstacle, that team is more likely to win than the opposing team with players of about the same “average” height. So in basketball, having one player with a height that is “extremely above average” could be a real game-changer.

So what does all this talk of “averages” have to do with Reserve Funding?

Almost all associations have a healthy (20 or more) list of reserve components. Even though Reserve Specialists do their best to make accurate replacement cost projections, over the course of 30 years some repair & replacement project costs will be “higher than projected” and some will be “lower than projected”. It would be reasonable to expect the highs and lows to “average out” over time.

This would certainly be true for fully-funded Associations (or Associations pursuing a Full Funding objective), which maintain healthy Reserve balances.

Full Funding vs. Baseline Funding Objectives in Practice

Let’s use a hypothetical example where an Association pursuing a Full Funding objective has $500,000 in reserves, with a big asphalt project budgeted to cost $300,000. If the actual project cost turns out to be $350,000 (i.e. $50,000 over budget), the Reserve Fund balance would drop to $150,000 instead of the anticipated $200,000. At the other extreme, if the actual project cost came in at $250,000 (i.e., $50,000 under budget), the Association would end the year with $250,000 in Reserves. That’s a total swing of $100,000, but there are no ill effects on the Reserve Fund balance or the ability to accomplish the repairs & replacements in a timely manner.

But if a Baseline-funded Association only has the $300,000 in Reserves budgeted for the asphalt project, the Association is in big trouble if the actual project cost turns out (just like in the example above) to be $350,000 ($50,000 over budget). The Association has created a situation where a “deviation from average” on one side (in this case going over-budget) creates a critical problem. Baseline-funding doesn’t provide the margin necessary to allow the “highs” and “lows” to average out over time. Like the basketball team example, repair or replacement projects that cost more than anticipated become game-changers. And the Association suffers the fate of the non-swimmer who drowned in a small, but deep area of a lake that “averaged” three feet deep.

The “Flaw of Averages” explains why Associations striving to make timely repairs & replacements in large expense years with only a barely cash-positive Reserve balance often face a major cash flow problem. And being unable to complete reserve projects in a timely manner due to insufficient funds has an unfortunate domino effect: deferred maintenance, declining property values, the upheaval of a Special Assessment, or the prospect of applying for a bank loan.

It has been our experience, based on data from over 30,000 Reserve Studies, that baseline-funded Associations suffer these unfortunate consequences about 50% of the time, in those critical, high-expense years. Now that’s a number that needs no explanation!