Owning property within a HOA community offers the security of shared responsibilities. Yet, like every advantage, it brings with it the challenge of shared financial risk, particularly when it comes to your HOA reserve fund. Ignoring reserve funding is an invitation to these unpleasant surprises. So how do you ensure you’re adequately preparing for future expenses?

Tools to Calculate Reserve Funding

A. Component Method:

This method requires Reserve transfers for each component be calculated separately, then summed together for an Association total.

B. Cash Flow Method:

Unlike the component method that zeroes in funding for each separately, the cash flow or pooled method creates an income stream that offsets the annual reserve expense totals (overall income vs. expenses). The goal? Ensuring you have enough for all expenses each year and jump-start the next. Take a deeper dive into the Cash Flow Method and Component Method here.

HOA Reserve Rules and Guidelines

The National Reserve Study Standards, first published in 1998, provide a guiding framework for reserve funding. They entail the association’s obligation to the component, a reasonable anticipation for each project, and that they are a significant cost. Keep in mind the key principles to proper reserve funding:

- Sufficient cash: Always have enough to meet future expenses.

- Stable Reserve transfer rate: Predictable, steady transfer ensures consistency.

- Fiscal responsibility: It’s all about being prudent and making sure every cent is accounted for.

- Benefit owners: A good practice for condos is to fund a minimum of 10% of the budget towards reserves. This can be advantageous for condo owners seeking mortgages. A 2021 study indicated that 99.85% of condo associations needed more than 10% of their budget for reserves.

Embracing the tools and rules of HOA reserve funding isn’t just about compliance. It’s about understanding that every decision you make, every dollar you set aside, contributes to a harmonious community. Empower your HOA community by making informed, responsible decisions about your reserve fund. The foundation of every thriving community is foresight, preparation, and a collective commitment to the future.

What’s Your Starting Point

The starting point determines the health and strength of your HOA reserve fund. Are you on track to cover upcoming expenses? If your answer is ‘no,’ you’ve got some catching up to do. Most HOA expenses are based on estimates, which as we know, can often vary. This uncertainty calls for a margin – but how much should you set aside?

What Your Reserve Fund Must Do

The underlying goals of reserve funding are relatively straightforward:

- Adequacy: Ensure that there’s enough money for each project.

- Responsibility: Your funding plan must be fiscally responsible. This protects the board and ensures decisions are made on solid ground.

- Efficiency: Aim for the most cost-effective funding plan for homeowners.

Remember, while you may have a plan, external factors such as Mother Nature and Father Time play a crucial role. They’re unpredictable and don’t operate according to our plans. This is why a good margin is essential.

How Much Margin Do You Need For Reserves?

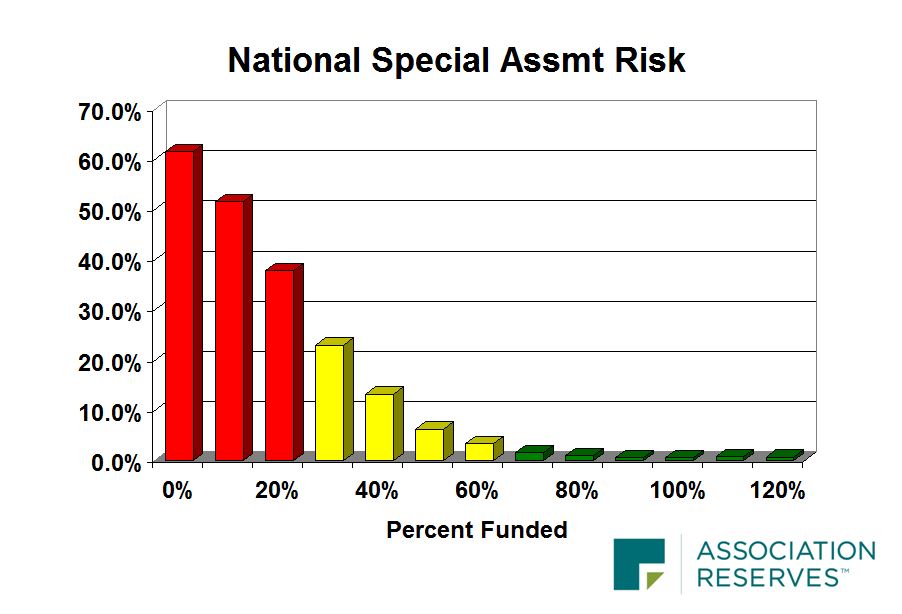

Based on national statistics, associations closer to 0% funding are at a higher risk of special assessment. On the contrary, those above 70% are relatively safe. If you aim too close, you risk landing in a danger, and aiming safely minimizes risk for your HOA.

3 Reserve Funding Types

The National Reserves Standards highlight three primary funding goals:

Baseline Funding: This is the bare minimum where the reserves balance remains above zero. It aims to keep the reserve cash positive but doesn’t offer as much buffer as full funding.

Full Funding: Here, the reserve balance matches the wear and tear the association experiences, leading to a substantial bank balance. This strategy offers the best insulation against unexpected costs.

Threshold Funding: This is a mid-way point, either a chosen cash amount or a percentage funded amount.

To simplify: baseline funding carries risks, while full funding leans towards complete safety.

Lowering Costs for Homeowners

The most effective way to minimize costs for homeowners is through strategic planning. A roof project costing $250,000, for example, can be funded with budgeted funding, resulting in significant savings for homeowners. Taking out a loan close to the project’s start date can increase costs by nearly $98,000, indicating the importance of early planning.

Reserve Fund Strategy

Balancing the HOA reserve fund isn’t just about matching reserve income with expenses. It’s a strategic move that takes into account the starting point, external factors, and the ultimate goals of funding. As board members, it’s crucial to pick a safe target and plan ahead, ensuring the financial health of the association while making fiscally responsible decisions.

A well-planned HOA reserve fund ensures the community can cover the costs of future capital projects without resorting to drastic measures like levying special assessments or taking out loans. Let’s unravel how interest, inflation, funding goals, starting balance, and the size and timing of upcoming reserve projects shape your reserve funding plan.

How Inflation & Inflation Affect Your Reserves

Every HOA needs to account for interest and inflation when formulating its reserve fund strategy. Here’s why:

Inflation’s Sneaky Influence: If you think a mere 1% bump in inflation won’t rock your HOA’s financial boat, think again. A single percentage increase can hike your funding requirement by approximately 20%. This is because inflation amplifies the cost of all future expenses.

Interest’s Subtle Shifts: Conversely, interest has a subtler, yet crucial role. A 1% rise in interest can typically lead to a 5-6% difference in reserve funding. Remember, interest is based on the cash you actually have in the bank, not potential future expenses.

Here’s where our uPlanIt online reserve calculator offers a lifeline. You can test your budget with all of these factors through our online reserve calculator uPlanIt. Learn more about using uPlanIt here.

How Your Starting Balance Affects Everyone

Your reserve’s starting balance can spell the difference between smooth sailing and choppy waters. A robust starting balance can mean less monthly transfers are needed. However, if you’re starting from a weak position, you might end up paying more monthly or face special assessments.

For example, let’s consider an association that initially requires a $4,990 monthly transfer for full funding. But with a weaker starting point, say from 12% funded, that amount spikes to $5,610 monthly. The same expenses loom, but now the association has to play catch-up, with owners bearing the burden.

HOA Emergencies Happen

Emergencies, like unexpected roof repairs, can drain the reserve fund. The earlier big-ticket items appear in your schedule, the more strain they place on your reserves.

Our sample HOA, previously having a relaxed start, suddenly faced a roof replacement in the initial year. This unexpected expense meant they had to navigate a whopping $100,000 special assessment. The lesson? Always be prepared for the unexpected.

The Reserve Fund Must Work For YOUR Association

In HOA reserve fund planning, there’s no one-size-fits-all. Every association’s needs, challenges, and goals are unique. For example, associations facing immediate financial pressures may require custom solutions, like starting with a lower monthly transfer and ramping it up each year.

With a comprehensive understanding of how inflation, funding goals, and other factors impact your plan, you can craft a strategy that ensures your association sails smoothly through future financial storms.

Reserve Fund Do’s & Don’ts

Every homeowner’s association HOA faces a universal truth: deterioration happens. While it’s inescapable, the ways in which we respond to this slow decay can determine the long-term financial health, homeowner satisfaction, and property values within the community. As experts deeply entrenched in the nuances of the HOA universe, our mission today is to guide you through the crux of “HOA reserve fund” management and the do’s and don’ts that accompany it.

- Deal with Deterioration

Deterioration within your association isn’t a matter of if but when. Physical assets, whether it’s the clubhouse pool, playground, or the very roads we drive on, will degrade over time. This is the work of nature that refuses to negotiate. Your role as an HOA board member is not to sidestep this truth, but to plan for it. - Avoid Minimizing Reserve Funding

Minimizing your HOA reserve fund doesn’t minimize costs. On the contrary, it postpones them, pushing the community into the treacherous waters of special assessments. This not only jeopardizes property values but also escalates the risk of liability. So remember, minimizing isn’t optimizing. - Use the Cash Flow Method

One of the standout strategies for your HOA is the cash flow methodology. This approach, embraced by many HOAs, provides flexibility and ensures efficient cash use. For many associations, it also translates to lower funding requirements due to its adaptive nature. - Don’t Compare Your HOA to Other Communities

It’s essential to recognize that no two associations are identical. Comparing reserve transfers directly can be a recipe for confusion. Factors like starting financial positions, maintenance expenses, and even interest rates can significantly vary. The focus should always be on what’s right for your association. - Face the Reality of Your Association

There’s a prevailing misconception: the board’s purpose is to maintain assessments as close to the previous year’s figures as possible. However, this approach is a ticking time bomb. A board’s true calling is to budget according to the association’s needs, ensuring its long-term viability. - Be Transparent

Perhaps the most resonating point from our discussions has been the emphasis on transparent communication. Homeowners deserve to understand the REAL costs of living within the association. By being upfront about these expenses, you empower residents to make informed decisions and earn their trust. - Update Your Reserve Study

Start your year on a note of guided empowerment: update your reserve study. This is your roadmap, the compass that guides financial decisions. By staying updated, you ensure that every dime channeled into the HOA reserve fund is a step toward a flourishing community.

Why Your Reserve Fund Matters

When we talk about HOA reserve funds, it isn’t just about meeting standards or avoiding special assessments. It’s about fostering a sense of community, security, and stability. A well-funded reserve ensures homeowners won’t be caught off-guard with unexpected expenses. If you want to learn more about what defines your reserve expenses, check out our breakdown of how HOA expenses are determined here. Moreover, by adhering to the National Reserve Study Standards, you’re ensuring fairness, responsibility, and, ultimately, peace of mind for all members. Effectively managing your HOA reserve fund, means safeguarding a community’s legacy and its future.

With Association Reserves by your side, you have access to a wealth of resources and information. We’re here to assist you every step of the way. Check out the rest of our articles here, or subscribe to our YouTube channel to follow along on future HOA tips like this every week!