Whether your HOA reserve fund is modest or substantial, the pressing question remains: How can you best manage this crucial financial resource for your entire community? In the current climate where inflation looms large and investment opportunities are rising, understanding the intricate balance of community safety, growth, and fiscal responsibility is paramount for managing your reserve fund.

The Inflation Impact

Inflation is an invisible force that can erode the purchasing power of your reserve fund. As costs rise, it is crucial to develop a strategy that not only preserves but potentially grows your fund.

As a board member, you’re not just managing funds; you’re stewarding the financial future of your association. This involves the 3 responsibilities of The Business Judgment Rule: ensuring care and diligence (duty of care), prioritizing the community’s needs (duty of loyalty), and being proactive in decision-making (duty of inquiry).

HOA Reserve Fund Investment Strategies

Don’t go it alone! Here’s where the expertise of an investment counselor becomes invaluable. Their guidance can help you navigate the complex world of investments, ensuring your decisions align with the best practices and legal requirements specific to your HOA.

Assess Risk vs. Reward

- Understand the different types of investments available and their associated risks

- Aim for a balanced portfolio that aligns with the community’s risk tolerance and investment horizon.

Manage Cash Flow Needs

- Ensure sufficient liquidity to meet short-term obligations.

- Develop a timeline for anticipated expenses to determine how much of the fund can be allocated to longer-term investments.

Monitoring & Adjusting Reserve Fund Strategies

- Regularly review the performance of your investments

- Be prepared to adjust your strategy in response to economic shifts or changes within your community.

With inflation on the rise and trouble in the banking sector, understanding how to protect and grow your HOA reserve fund is more important than ever. Set the right approach, and your reserve fund will be a robust tool that ensures your community thrives even in the face of economic uncertainties.

The 3 Pillars of HOA Reserve Fund Investments

Guided by reserve investment expert Dave Lynn’s principles, let’s review the three core components of reserve fund investing: Safety, Liquidity, and Return. In the midst of bank failure and high investment returns, these principles are a beacon in our current economy.

Safety First

- FDIC-Insured Investments: Your priority is the absolute safety of the homeowners’ money. Opt for FDIC-insured CDs – the CD should be purchased at amounts less than the $250,000. and money markets, ensuring every penny is protected. The only investment other than FDIC-insured CDs and money markets that are appropriate for community associations are US Treasury bills, Treasury notes and treasury bonds (individual treasury securities that were purchased in the name and tax ID number of the Community Association)

- Diversification: Spread your investments across different financial institutions to maximize FDIC insurance coverage above $250,000.

Optimizing Liquidity

- Meet Immediate Needs: Ensure you have immediate access to funds for upcoming reserve expenses.

- Balance Investments: Maintain a balance between liquid assets for short-term needs and longer-term investments for better returns.

Smart Returns

- Understand the Risk-Return Trade-off: Higher returns often come with higher risks. Stay within the realm of safe investments, with zero-risk as much as possible, like treasury securities and FDIC-insured options.

- Avoid High-risk Ventures: Steer clear of investments in volatile markets. Remember, you’re stewarding other people’s money, and safety of the community comes first before getting a better return.

Make an Investment Strategy

Inflation can diminish the value of your funds over time, making it crucial to choose investments that can at least keep pace with inflation. Keep a close eye on interest rate changes and understand how they can affect your investment choices and returns.

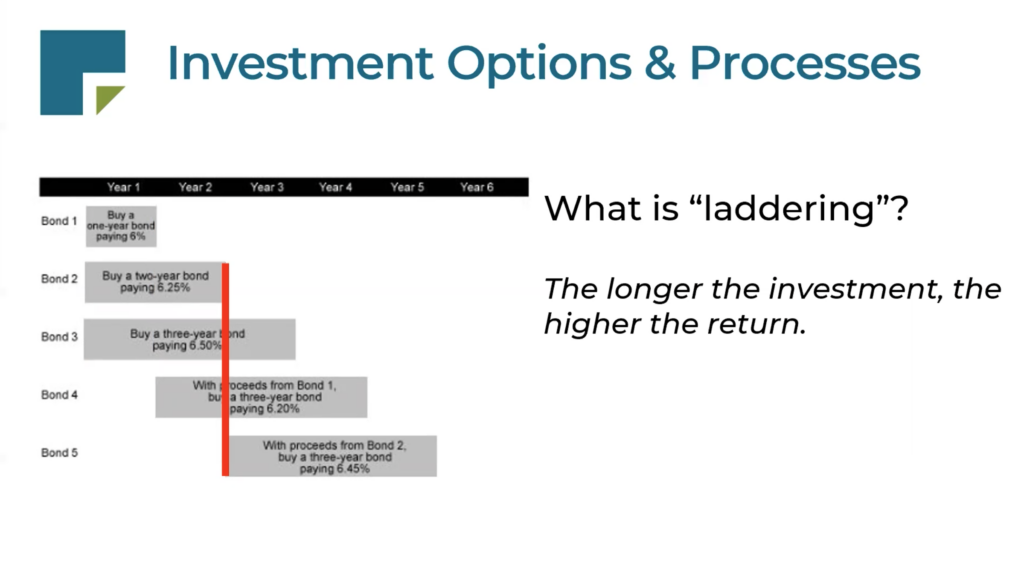

Laddering CDs: We recommend keeping roughly 10% of the association’s funds in a series of FDIC-insured money markets, and the other 90% laddering or staggering the maturities of CDs so you have something maturing a couple of times a year. Whether rates go down or rise, you’ll have money maturing that can be reinvested to those new and even higher rates. By reinvesting maturing CDs, you gain both interest rate advantages and necessary liquidity.

For example, if you set up a three year CD ladder, with CDs maturing every six months, then six months from now, your first CD is maturing; you could reinvest the maturing CD into a three year CD. Over time, your portfolio will have the yield of a three year CD, which is almost always higher than the yield of a two year CD or a one year CD. But you have much more liquidity than we’re used to just by a three year CD, because you have money maturing every six months, as well as roughly 10% in the money market.

Align Investments with Reserve Studies: Use your reserve study as a roadmap for timing investments, making sure funds are available as significant expenses appear.

Managing an HOA’s reserve fund in today’s economic environment requires a judicious balance of safety, liquidity, and return. By adhering to these principles and staying informed about the latest financial trends, you can ensure that your community’s financial future is secure, even in the face of rising inflation.

What Inflation Means For Your HOA

Offsetting Inflation: Inflation affects not just the value of money but also the cost of future projects and repairs. It’s essential to recognize that investment returns are unlikely to completely offset inflation.

Long-Term Planning: Effective reserve fund management involves long-term planning using updated reserve studies that factor in inflated costs. A good reserve study helps predict future costs, so you have sufficient funds every time you need it.

Investment vs. Spending Decisions: Understand that investment decisions should be separate from spending decisions. High inflation might prompt you to complete projects sooner, but it shouldn’t drastically alter your investment strategy.

Different Associations = Different Needs: Understand that reserve fund needs vary depending on the type of association, from HOAs to high-rise condos. Tailor your strategy accordingly.

Your Financial Advisor for HOA Reserve Fund Management

Expert Guidance: For complex reserve funds, consider engaging a financial advisor who specializes in HOA management to navigate investment options effectively. The right financial advisor should offer valuable insights without adding financial strain to your association.

What is a Healthy HOA Budget

Your reserve study is the roadmap for your cash flow and budget planning. Regular updates are crucial to reflect current costs and anticipate future expenses. Updating your reserve study helps account for inflationary pressures, ensuring you’re not caught off-guard by rising costs.

A healthy HOA budget allocates 55-80% for operating expenses, 15-40% for reserve funding, and about 5% for contingencies. Underfunding reserves often leads to relying on special assessments, a less effective and more burdensome approach.

The 5 Keys of Successful HOA Reserve Fund Management

Prioritize Association Needs: Focus on the essential needs of the association to ensure its long-term well-being.

Make Safe Investments: Preserve the integrity of the reserve funds by avoiding risky investments.

Get Expert Help: Utilize expert counsel for investment decisions and reserve study updates.

Regularly Update: Adjust your reserve and investment plans (including your reserve study) regularly to reflect changing costs, life expectancies, and economic conditions.

Test Your Budget Strategy: Take advantage of tools like uPlanIt to test various scenarios on your budget and understand the impact of different interest rates on your reserve funding requirements. Start using uPlanIt today!

As an HOA board member, your responsibility extends beyond mere management; it’s about ensuring the financial stability and future prosperity of your community. By staying informed, seeking expert advice, and updating your reserve study and investment strategies, you can effectively navigate the challenges posed by inflation and other financial uncertainties. Remember, your proactive steps today lay the groundwork for a thriving community to last for generations to come.