Note: This is an update to an article we published in 2012 that was based on 30,000 completed Reserve Studies: A Whopping 70% of Association-governed Communities are Underfunded.

Understanding the Problem

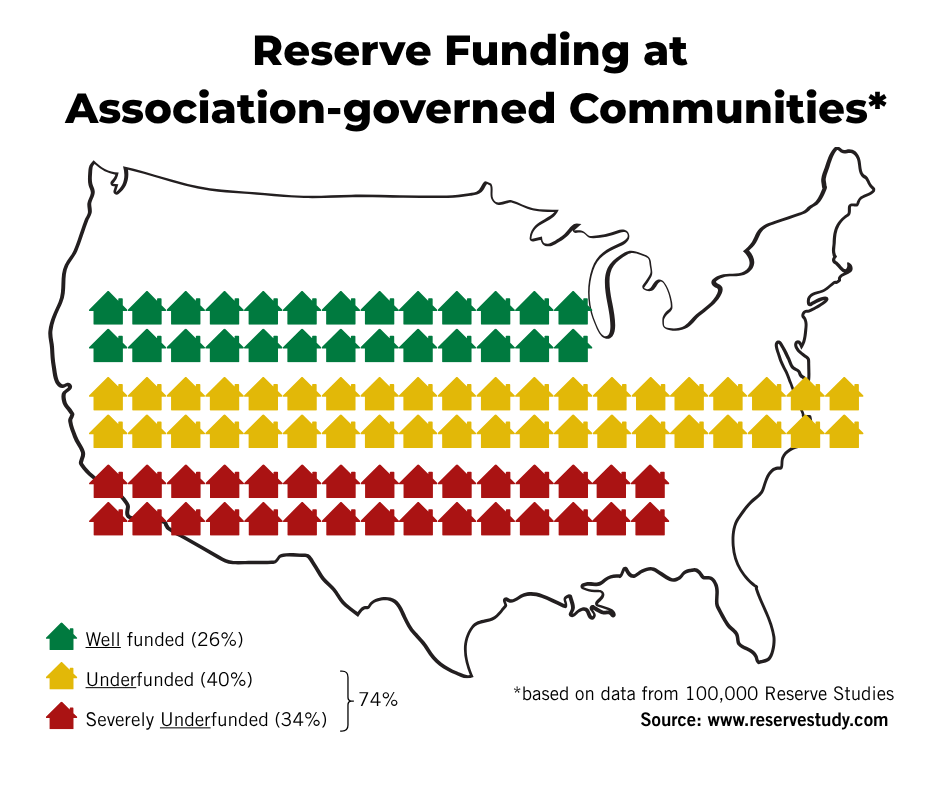

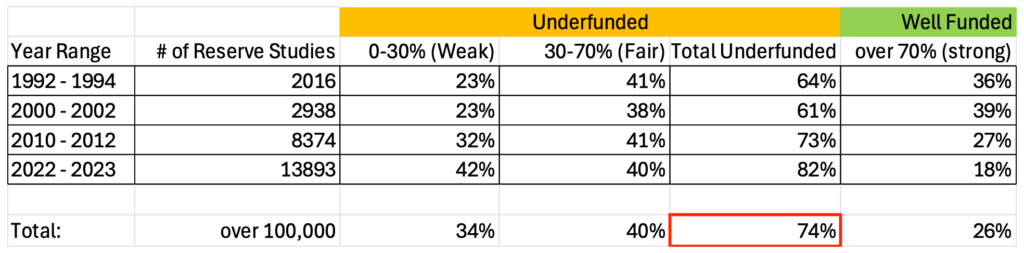

Across the US, most communities face the hard truth of underfunded reserves. This statement is made based on an analysis of over 100,000 Reserve Studies prepared by Association Reserves in the 39-year time period from 1986 -2025, using terminology and calculation protocols established in CAI’s National Reserve Study Standards. The results, which were based on a measure of Reserve Fund strength called “Percent Funded”, determined that 74% of Associations were less than 70% Funded.

Less than 70% funded is the point where an Association becomes ‘underfunded’

— meaning it may not have enough saved in Reserves to cover expected projects.

When an association’s Reserve Fund is less than 70% Funded, it means the cash available for Reserve projects is less than 70% of the monetary value of deterioration those funds were designed to be used for.

Put simply, if your community is 30% funded, you only have 30 cents saved for every dollar of wear & tear the property has accumulated. This puts the association at risk of not having sufficient cash to perform scheduled (and usually necessary) reserve projects on a timely basis.

You can measure how much common areas have worn out — in dollars — using something called the Fully Funded Balance (FFB). FFB is the computed value of the deterioration of all the Association’s reserve projects. This figure is determined by multiplying the “fractional age” (Age/Useful Life) of each component by its current estimated repair or replacement cost, then summing them all together.

How Percent Funded (% Funded) is Calculated

% Funded = Reserve Fund Balance/Fully Funded Balance (FFB)

Let’s consider a simple example:

Imagine an Association on the first day of their fiscal year, with $40,000 in Reserves, only two common area maintenance responsibilities:

- Roof: replaced 7 years ago, Useful Life of 20-years, current estimated cost $200,000

- Painting: painted 3 years ago, Useful Life of 5 years, current estimated cost $50,000

| Component | Age (years) | Useful Life (years) | Cost | FFB Computation | Fully Funded Balance |

| Roof | 7 | 20 | $200,000 | 7/20 x $200,000 | $70,000 |

| Painting | 3 | 5 | $50,000 | 3/5 x $50,000 | $30,000 |

| Total FFB: | $100,000 |

So, the Fully Funded Balance is currently $100,000.

$100,000 represents the monetary value of the physical deterioration that has occurred since the roof was last replaced and since the building was last repainted. This also represents the ideal target for how much the Association should have set aside in Reserves to completely offset this deterioration.

Now let’s do the Percent Funded calculation:

Percent Funded= Reserve Fund Balance ($40,000)/Fully Funded balance ($100,000) = 40%

Why Proper Funding Matters

At first glance, $40,000 in the bank might sound healthy. But compared to the growing obligation of $100,000 worth of physical deterioration, this means the Association has only 40% of the funds on hand that it should have at this time.

This fictional association is “behind” in collecting the funds from the Owners that will prepare the association to complete the eventual roof replacement and repainting project in a timely manner. Without change, that shortfall can mean special assessments, loans, or project delays — all of which cost homeowners more in the long run and threaten property values.

A Troubling Trend Over Time

When we look at the data through the years, we note some troubling trends:

For many years, the total number of underfunded associations ranged from 61 to 73%. But in our most recent two-year study (during the high inflation years and COVID-19), we found that Associations were significantly falling behind in their Reserve Fund strength, with 82% of our clients falling into the “underfunded” category. That’s the highest underfunding rate we’ve ever recorded. We attribute this to higher costs (driven by a high rate of inflation in those years), and the higher level of scrutiny Reserve Study professionals placed on Client properties in the years immediately following the 2021 tragic collapse of Champlain Towers South.

While many states do not legally require Associations to fund reserves to a specified level, best practice is to fund reserves at a rate that keeps close pace with ongoing common area deterioration. This approach shares the true cost of upkeep fairly among all homeowners and yields a strong enough Reserve Fund balance to sustain the common areas and protect property values.

Averaging the results of the more than 100,000 Reserve Studies we’ve prepared for clients in all 50 states, 74% of associations are teetering on the verge of needing special assessments or loans to perform their major repair or replacement projects in a timely manner.

What Boards, Owners, and Prospective Buyers Should Do Next

Most Association-governed communities across the nation are indeed in a financially challenged state

and their Reserve Funding needs to increase dramatically to catch up with the true cost of home

ownership that has largely been ignored.

- Board members need to take bold, proactive steps — courageously raising assessments to turn the tide on underfunding

- Current owners should understand that maintaining real estate is costly — and support board decisions that protect long-term property values

- Prospective buyers should always ask about Reserve Fund strength — it’s the best way to avoid surprise special assessments after moving in

In summary, well-funded Reserves protect everyone — owners, buyers, and Board members alike. When

Boards adopt sound funding practices, they minimize financial strain, preserve property values, and ensure

that common areas are maintained responsibly and consistently. A well-managed Reserve Fund reflects

prudent governance and a shared commitment to sustaining the community’s long-term health and stability.

See related article: Relationship between Percent Funded and Special Assessment Risk