- Article

Preventive Maintenance Planning: Incorporating It into Reserve Studies

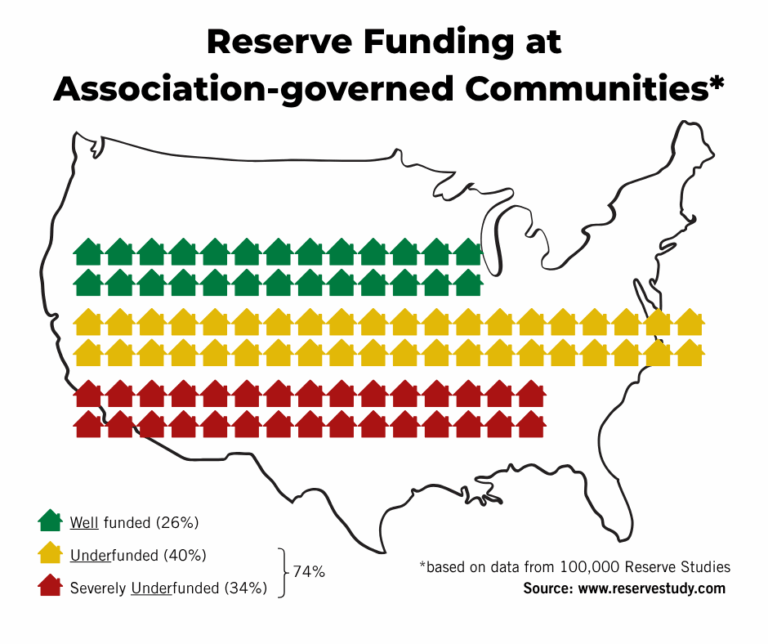

Preventive maintenance is the backbone of effective community asset management. It’s about addressing small issues before they turn into significant, costly problems. For homeowners associations (HOAs), incorporating preventive maintenance into reserve planning can make a dramatic difference by reducing costs, extending asset lifespan, and supporting financial stability.