6 Ways to Minimize your Reserve Contributions

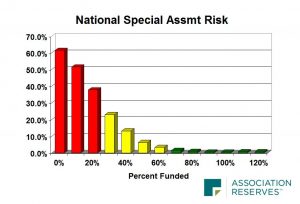

Why put more money into your Reserve Fund than necessary? I can’t think of a good reason! You don’t want to make Reserve contributions that err on the side of being too little, that may lead your Association toward a Special Assessment, borrowing, or the even higher costs that come with deferred maintenance.